Chip shortage: What’s really behind the crisis

Due to the so-called hog cycle, which is known as a periodic fluctuation from economics and to which the now 70-year-old semiconductor industry is subject, supply fluctuations are not completely foreign to the market. But what is happening right now in the automotive industry in terms of chip shortages is probably causing great amazement among all the players. Together with industry insiders, we want to take a brief look at the causes and touch on the sometimes complex interrelationships.

A commentary by Michael Pollner.

- Chip shortage - The history

- Why the pandemic was just a drop in the bucket of chip shortages

- Golden times for carmakers - despite chip shortage?

- The scarcest commodity in the automotive industry at present is microcontrollers

- The solution to the chip shortage will also lie in the separation of hardware and software!

Michael

Marketing Professional

11.02.22

Ca. 9 min

Chip shortage – The history

To get into this phenomenon, a brief historical review is needed: Between 1950 and 2000, we could simultaneously observe how high market prices, especially in the memory sector, led to increased investments in the semiconductor industry. After a certain delay, namely the construction and completion of the factories, these led to oversupply and consequently to a drop in prices, which caused many suppliers to reduce their production again. The excess demand that developed over time then caused prices to rise again. The period of this recurring cycle, which has characterized the industry ever since, depends on the speed of investment.

Since 2000, however, things have been more moderate. Why? Because the number of players in the storage area has been drastically reduced. This reduction was due to the fact that not all competitors had the financial strength to keep up with the “big three”, namely Samsung, Hynix and Micron. Qimonda also fell by the wayside as a result and eventually became insolvent in 2009.

Why the pandemic was just a drop in the bucket of chip shortages

However, there are far more underlying causes for the current shortage. In the meantime, the technological economic war between the U.S. and China also reached a whole new level. A U.S. government ban on the sale of Leading Edge manufacturing machinery to Chinese companies led to short-term hoarding purchases on the part of the Chinese. Companies such as Huawei virtually bought the Chinese semiconductor market – in particular the leading Taiwanese semiconductor producer TSMC – dry and in some cases ordered twice the annual demand. This development even led to contract manufacturers, such as the Chinese supplier SMIC, making entire production corridors available exclusively to Chinese customers. The intensification of the trade dispute in 2020 thus caused a huge increase in demand for components in China’s domestic market. This was a bitter pill for the rest of the world market, as volumes for customers outside China became dramatically scarcer.

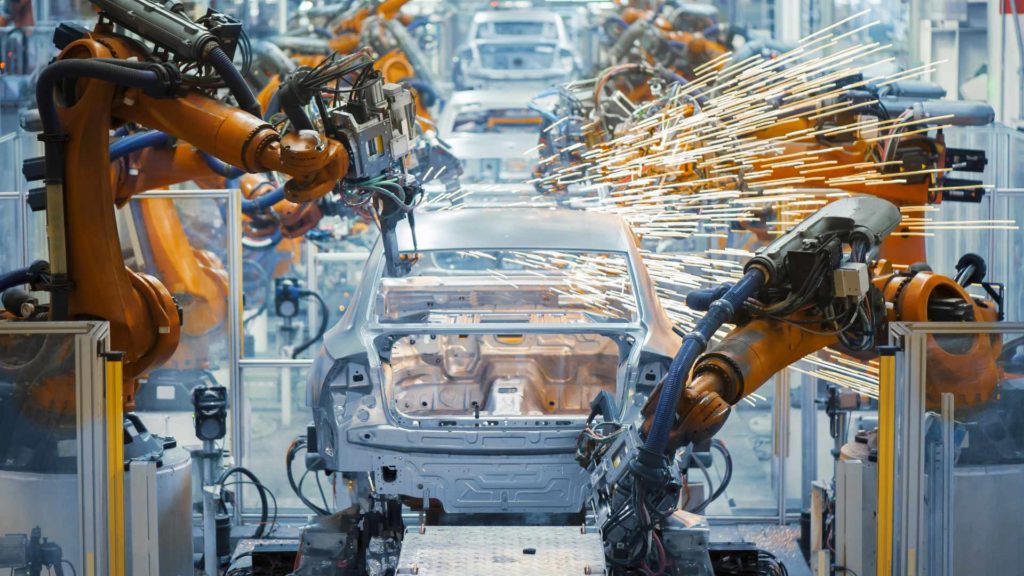

The corona-induced economic slump further shook up the market. The sudden downturn in many sectors led to the hitherto first-time and very rare effect that macroeconomic drivers no longer ran congruently across all markets. So, within the economy, different growth took place per industry (e.g. consumer electronics vs. automotive industry) And so, not only did the car production lines come to a standstill, but also “order cancellations” occurred.

On the other hand, there were also the Corona winners we all know, who had been waiting for additional production corridors in the semiconductor industry and secured corresponding quotas. The unexpectedly swift upturn towards the end of 2020 also had the assembly lines of the automotive industry running again. An industry that previously canceled all production lines now encountered manufacturing corridors bulging with consumer and communications electronics in the semiconductor industry. The automotive industry was thus left behind. The state of affairs that tech giants like Apple now have particular bargaining power over production corridors is not helping to ease the tension among automakers. At this point, it should be noted that in 2020, the global purchasing volume of the entire automotive industry in the semiconductor sector was $37 billion (source: https://www.costconsult.de/halbleiter-was-steckt-hinter-dem-chipmangel/). Apple alone acquired $45 billion worth of semiconductors in the same year (source Gartner, https://macdailynews.com/2021/02/18/gartner-apple-extends-lead-as-the-no-1-semiconductor-chip-buyer-in-2020/). At the same time, the market was severely impacted by accidents such as the fire at a factory belonging to semiconductor manufacturer Renesas. The tanker disaster in the Suez Canal and the severe winter storm in Texas also had a negative impact on the supply chains of corresponding components at this time and fueled the chip shortage.

Golden times for carmakers – despite chip shortage?

But how can it be that the automotive industry is currently making enormous profits despite the chip shortage? It’s a simple calculation: industry insiders know that the shortage now created means there is no need for automakers to offer discounts on vehicles. However, the high margins are also due to the fact that the OEMs concentrate on the high-priced or high-margin models especially in times like these and install the few available chips in exactly these models with the highest priority. Without further ado, for example, only one premium sedan is produced instead of several mid-range vehicles. Added to this are measures such as delivering a new car without the special equipment ordered or without a duplicate key, which enable optimum housekeeping with the few chips available.

The scarcest commodity in the automotive industry at present is microcontrollers

Of course, the psychological effect of hoarding purchases was not absent. There were double, even triple orders for semiconductors, especially microcontrollers. However, the automotive industry had to painfully realize that these cannot simply be produced and delivered like screws due to long lead times of up to 6 months. Considering that semiconductors account for just about one percent of car manufacturing costs, it’s worth noting that just that one percent can get in the way of a car’s potential one hundred percent of sales if they are missing.

And the chip-related change in the market is also noticeable in everyday project work. “Already at the start of software development for a new electronic control unit (ECU), we have to define the chip together with our customers because of a lead time of more than 12 months,” explains Jens Schmidt, head of embedded development at Cognizant Mobility, to avoid a chip shortage in ongoing projects.

The solution to the chip shortage will also lie in the separation of hardware and software!

Due to this immense leverage effect, it seems not surprising that the semiconductor market is massively moving into the focus of politics and especially of OEMs. One interesting development that industry insiders are observing in this context is OEMs contacting semiconductor manufacturers directly, having previously communicated only through TIER 1 and TIER 2 suppliers. The trend even goes so far that automotive manufacturers reserve production corridors at semiconductor manufacturers for their suppliers.

Embedded developer Jens Schmidt sees another approach. Accordingly, it is crucial that, in the event of a chip shortage, a chip or derivative change can be made without major effort, thus creating an opportunity to use other chips that are available at the time if the worst comes to the worst – without having to accept any compromises in the implemented customer functionality. This can be done by reconfiguring the hardware-related software layer with toolsets from Cognizant Mobility to enable the separation of hardware and software. The use of ADAPTIVE AUTOSAR and service-oriented architectures is another building block here.

Particularly because many automotive manufacturers will be relying on their own innovative capabilities in the future and would like to cover a large part of the value creation, which is currently in the hands of suppliers – and also the semiconductor industry – internally, it remains exciting to see in which direction the market will develop.