Bye Bye Leasing: Will the subscription model for vehicles become the new standard by 2030?

The noise only lasted a short time. A sharp "clack" as the pebble touched the windshield. The windshield wipers have a lot to do because of the rain, and only after arriving in the driveway at home does it become clear: stone chips. A sigh. So much administrative work - fortunately insured. How exactly, and with what follow-up costs, often depends on the financing model chosen: Is it your own car? Is it financed? Car sharing, car rental, leasing or subscription model? With the latter, you're in the clear: the flat-rate tariff for cars, as Wikipedia summarizes it succinctly, covers all costs incurred. That sounds good! Too good to be true or at least serious? Is the industry leader "leasing" in trouble and, as a recent study suggests, will it even have to give up its pioneering role among vehicle rental models by 2030?

Our article takes a look at the advantages and disadvantages of the subscription model, provides field reports, interviews with the operators of the aforementioned study, Mathias Albrecht from ViveLaCar and Prof. Dr. Helene Wisbert, Professor of Automotive Economics, and dares to attempt a comparison. Have fun!

- Subscription model: What is it and how does it work?

- Advantages of the subscription model: why it can be worthwhile

- Summary of the advantages of the subscription model

- For whom is a subscription model worthwhile?

- A subscription model has these disadvantages

- Summary of the disadvantages of the subscription model

- Car subscription model: current statistics, providers and trends

- How interesting are subscription models for vehicle manufacturers?

- Subscription model vs. classic leasing

- Subscription vs. leasing: who wins now?

- Subscription models until 2030: an outlook

Marc

Marketing Professional

11.01.24

Ca. 48 min

Subscription model: What is it and how does it work?

In order to compare the subscription model with classic leasing, it is necessary to take a detailed look at the subscription model in summary. Basically, this is a rental relationship, similar to financing or leasing, in which users can rent and use a vehicle for a limited period of time subject to certain conditions. Just like smartphone contracts, for example. The independence criterion for the subscription model is the all-inclusive nature of the offer, practically the all-inclusive vehicle rental, which usually already includes the following points:

- Monthly vehicle rental (usually between 200 and 500 euros for mid-range cars)

- Vehicle tax

- Car insurance

- Maintenance and repairs

Depending on the provider and individual contract, benefits such as mobility guarantees at home and abroad may be added on the credit side, while on the debit side there may be mileage limits per month. Various packages can often be booked for this, which add more mileage for an extra charge.

In return, users of a subscription model only have to bear the costs for fuel and maintenance, or fuel can of course also be omitted for electric vehicles. Unlike mobile phone contracts, the terms of subscription contracts are not yet subject to industry-wide standards and generally range from one to 36 months. At the end of this period, the vehicle is returned and, unlike with leasing, there is neither a final installment nor a purchase by the user, unless individually agreed. A deposit is also not usually necessary. Depending on the value of the vehicle and the provider, an initial payment may be due on a subscription, but this has not been common practice to date, as the value or depreciation does not play a role in the subscription model. In contrast to classic leasing, where the monthly installment does not compensate for the initial loss in value of the new car, but (in some cases far) exceeds it later on, which results in compensation and is therefore only worthwhile for the provider due to the longer term of the contract (which is also the reason for the premature termination of a leasing contract, which is very difficult to implement and often associated with high costs).

Advantages of the subscription model: why it can be worthwhile

An impressive advantage of the subscription model is that the vehicle can be exchanged for another model during the subscription period, again depending on the contract, often at short notice: a nippy sports car at the weekend and a family-friendly estate car during the week? Generally conceivable, although not always easy to implement logistically. But possible! A young family that needed a van for the first 24 months and can now manage with a sedan, for example, can easily switch vehicles in most subscription contracts.

As if that wasn’t enough, there is another economically relevant factor that Mathias Albert rightly mentioned in our interview – Mathias, who took the time to answer our many questions, is a shareholder and founder of ViveLaCar, one of the best-known providers of subscription models: “In the case of (car) subscriptions, there is a contractual guarantee of a short notice period of usually only 4 weeks. In addition, subscriptions do not affect the rating and are therefore much more flexible to handle than leasing. There is therefore a lot to be said for subscription instead of leasing, because it is more flexible and ultimately easier for both companies and private individuals. In addition, a lot of things have to be taken into account when leasing, such as maintenance, wear and tear, tires, insurance, etc.. This is already included in the subscription price. This also makes the product much more transparent and simpler.”

By the way – according to a recent study, this is relevant for 71% of all subscription model customers: Free delivery of the subscription vehicle to the front door is also included with many providers.

Summary of the advantages of the subscription model

- No initial and final installment

- Low subscription rate (depending on vehicle class)

- Contracts with short terms in some cases

- Tax and vehicle insurance included

- Maintenance and repairs included, winter/summer tire change included, often with mobility guarantee, rental car, etc.

- Flexible exchange of the booked vehicle model

- Large selection of models thanks to large vehicle fleets

- Subscription can usually be taken out via app or online

- Sustainable usage model by foregoing ownership and potentially easier access to electric vehicles

The last area mentioned here, electromobility, should also not go unmentioned: battery replacement, for whatever reason, can still be particularly expensive these days, and not all car insurance companies offer this as an inclusive service (or have this contractual point paid for in accordance with their status). With a subscription model, this is also included and thus guarantees an important customer factor: security, both in physical and planning terms. Mathias also emphasizes this: “Subscription models are particularly conducive to the switch to electromobility, as they significantly lower the barrier to trying out electromobility. This is because it does not involve a long-term commitment and very high costs, but only a manageable monthly subscription price. We are therefore certain that the switch to electric in particular will be much easier and quicker in the future by means of a subscription.”

For whom is a subscription model worthwhile?

A subscription model is therefore particularly suitable for two outer groups of the same spectrum: on the one hand for frequent drivers who do not want to make a long-term commitment to a vehicle, and on the other hand for infrequent drivers for whom financing or leasing is often not cost-benefit-neutral. The middle class certainly has other options, but can also benefit from a subscription model.

The subscription model as a mobility concept in companies is a particularly strong component, even beyond private individual transportation. Thanks to the high degree of flexibility, employees can obtain company cars more cheaply than in leasing contracts and, at least in principle, also offer employees a certain degree of flexibility in their choice of vehicles. In particular, the switch to electric vehicles can be easily implemented in environmentally conscious companies. As costs for maintenance and repairs are included – which are undoubtedly incurred by frequent drivers in particular – this can be associated with less effort and, above all, costs for companies. The fact that a subscription installment from the gross salary is cheaper for employees than financing from the net salary is not a unique selling point of the subscription model, but it is worth mentioning at this point. Stefan Sauer, Head of Training and Consulting and responsible for Digital Sales and Aftersales at Cognizant Mobility, also sees potential in this area: “If the much-discussed company car privilege is actually abolished in the near future, this could mean a huge boost for subscription models. These are particularly suitable for companies. Manufacturers will also be able to benefit greatly here: In cooperation with dealers, or, thinking ahead, fully automated exchange points, a simple mobility concept can be created that will be customer-oriented and sustainable.” If a company would like to obtain further expertise as part of the mobile transformation or needs support for the process within the company, Stefan not only provides advice and professional help, but also concrete support if required, for example through workshops, process finding and market support. Be sure to keep an eye out, as there are some projects planned here, keyword “Think Tank”.

However, a vehicle subscription is particularly worthwhile for vehicle users who attach little importance to ownership, status or individualization and for whom the cost-benefit aspect is not always the decisive factor (we will come back to this point below), but who in return like to drive models in mint condition and appreciate flexible contracts.

This is also Prof. Dr. Helene Wisbert, Professor of Automotive Economics, who works for Ostfalia and as Director of the CAR Center Automotive Research, among others, is a recognized expert who provides valuable insights for numerous publications, is co-author of the study on subscription models and also patiently answered our questions: ” Anyone who (…) wants to drive a new car they have configured themselves is therefore more likely to find themselves leasing. From a financial perspective, it depends on the offer whether leasing or car subscription is more attractive. In contrast to leasing, the subscription includes insurance, maintenance and wear-and-tear service and winter tires or tire changes.”

So while leasing and the like are not yet completely dead, there are other beneficiaries of the emergence of subscription models in addition to individual users in the sense of end customers.

This is because the emergence of subscription models also has great disruptive potential with regard to the general transformation of individual transportation in German cities (probably also globally, although both the study mentioned several times and our interviews relate primarily to the German market). Many cities are working to reduce individual private transport, and the subscription model concept also offers advantages for retailers and manufacturers – customer retention is much easier than acquiring new customers, and loyalty and bonus programs are easier to implement with subscription models. One example would be the concept that Mercedes already operates today with its in-house financing program: Before the financing plan expires, customers receive a fully automated offer to switch from a C-Class to an E-Class for the same price, for example. Such offers are currently still rare in the subscription model due to the already favorable conditions, but will gain in importance over time. It will undoubtedly be interesting to see how OEMs with direct sales in cooperation with dealer and aftersales networks will position themselves in the competitive situation of subscription providers in the future, often still with a certain dynamic start-up quality. The market is competitive and First Movement is rewarded – this article will come back to this shortly with some evidence. However, it is safe to assume that the subscription model is a driving force. Whether this is an advantage may be decided on an individual basis: However, a reduction in mass traffic in city centers through subscription and sharing models is probably more likely to be seen as a positive side effect, as is the reliable database created by the experience gained from subscription models. Mathias Albert says: “We assume that the analysis and experience of user data, especially from our subscribers, will also be used by car manufacturers to improve their products in the future.”

With their strong digital basis, subscription models therefore make a significant contribution to making mobility more user-friendly. This is also necessary, as the lack of configurability of vehicles as part of the subscription model, for example, could be seen as a disadvantage – all the better if the existing selection is already optimally tailored to the user and their ideas.

A subscription model has these disadvantages

Where there is light, there is also shadow, and while at first glance the subscription model appears to be a trend from the U.S., which is also finding buyers in the domestic market for good reason, there are certainly criteria that potential users need to consider.

As a rule, it is not possible to terminate the contracts prematurely, even if the term is often shorter than that of classic leasing models, and a subscription fee is sometimes payable. Renewal is often not possible either, as older vehicles can be associated with higher risk and potential additional costs for the subscription operator: The older the vehicle, the more maintenance and repairs may be required, to name just one example of why subscription providers remove ageing vehicles from their fleets. So if you don’t want to repeatedly get used to new vehicles – which often require a certain amount of time to get used to as the possibilities increase – subscription models may not be the ideal solution.

The vehicle selection, which is usually conveniently available via app or website, usually describes the complete equipment of the desired vehicle. Customization is usually not possible, as these are existing vehicles in mostly large fleets, not new cars that are ordered from the dealer and configured as desired. This means that certain desired components may no longer be included when the vehicle is exchanged. In return, however, there is usually no or only a short waiting time for the desired car.

Speaking of time: Since a car used via a subscription is insured through the provider, car insurance companies do not recognize the driving times, at least as of November 2023 – so the no-claims bonus does not drop any further and can even be higher than before the start of the subscription due to the unrecognized driving experience with new insurance if the last own car insurance was more than seven years ago.

Last but not least, it may occur to you that certain providers also require a minimum age for taking out a subscription, which is often 21 and in some cases only 23.

Summary of the disadvantages of the subscription model

- Contracts often cannot be extended

- Takeover of vehicles not possible

- As a result, no long-term usable cars

- No choice regarding the equipment of the vehicle

- No recognition of driving experience -> no reduction in SF

- Minimum age as a prerequisite for concluding a contract, if applicable

- In rare cases “entry fee”

In conclusion, it must be admitted that a pure comparison of the advantages and disadvantages results in a clear “pro” for subscription models and this already shows that this topic will continue to accompany us in the context of mobility and even has the potential to become the standard model for car rental. So let’s take a closer look at some trends and potential for the future.

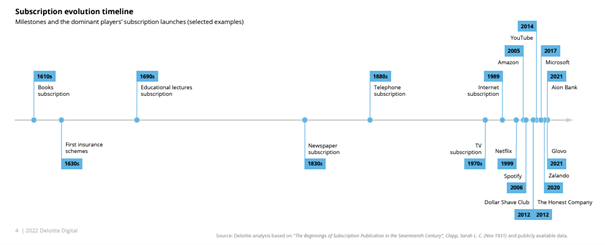

Car subscription model: current statistics, providers and trends

Vehicle subscription providers are quickly conquering the industry – which makes sense. We no longer buy DVDs, we watch Netflix or Disney+ instead, and we no longer spend hours rummaging through CD departments for new treasures (what a shame!), but subscribe to Spotify instead. We don’t own the music, but we borrow it as required for a lump sum. The fact that the concept works has been tried and tested millions of times: Wherever customers need products or services on a permanent and recurring basis, subscription models make sense (whereas occasional subscription offers for shoes, underwear or craft boxes, for example, have had to put up with some bitter blows).

Consequently, more and more competitors for car subscription models are appearing on the market, especially online. Well-known and in some cases internationally successful companies include:

- ViveLaCar : One of the few providers that also offers young used cars and one-day registrations and relies on cooperation with car dealers instead of a centralized offer

- Cluno: One of the first providers ever on the German market, but was bought up by Cazoo and largely wound up

- Abo-a-Car

- like2drive: Part of the powerful Fleetpool Group

- The rental giants also want to play along Sixt, Hertz and Avis

- OEMs such as Volvo and Volkswagen (including Audi and Porsche) offer subscription models, but in some cases only offer a very limited selection (Audi, for example, only e-tron 55 and e-tron Sportback 55)

- Stellantis: Offers the largest model range of the OEMs and includes Opel and Alfa Romeo, Peugeot, Citroen, DS, Fiat, Jeep as well as Suzuki, Hyundai and some VW models that do not belong to the Group

- FINN: from Munich, focus on sustainability with their one-third electrified vehicle fleet and CO² compensation

- Smive: Similar to ViveLaCar, they rely on new and used cars via dealers, as well as short contract terms

- Shell: Certainly the most bizarre entry in the list, they offer several e-vehicles under the name “Recharge”, such as the Porsche Taycan or Fiat 500.

- HUK-Coburg: Yes, they are also involved in their “car world” with currently 37 models

- Miles: Car sharing provider that does not yet offer car subscriptions, but has announced them

For the fun of it, here are a few interesting cases for the statistics – the data comes from the 2019 study by puls Marktforschung GmbH, one of the few concrete sources for the development of subscription models in Germany, as well as the study by strategy consultants Oliver Wyman.

- Younger and high-earning users are particularly interested in subscription models

- Around 21 percent of vehicle users reject subscription models, 39 percent in the “baby boomer” age group (aged 57 and over)

- German customers are interested in premium brands such as Mercedes, Audi and BMW

- Over half of users under the age of 30 would be prepared to pay extra for the option of an uncomplicated vehicle change within the subscription contract

- Up to 48 percent of users can imagine a subscription model, while only around 28 percent are prepared to finance or buy in cash

- While in Germany around 35 percent across all surveyed social classes are in favor of the subscription model, the willingness in the USA (24 percent) or Italy (19 percent) is significantly lower

- The desire for completely digital processing of car purchases or subscriptions is immense

How interesting are subscription models for vehicle manufacturers?

The development of the subscription models, which are certainly still a little jerky in terms of marketing at the moment and are rather slow to reach the target groups, is of great interest to the automotive industry, which has been struggling with new concepts for car sales for some time. Now that even former booksellers such as Amazon are entering the market for new cars, new mobility concepts and sales channels are in demand.

Many manufacturers are now faced with the optional extra (after the obligatory development and production) of developing their own channels, such as direct sales. Subscription commerce could certainly be a solution for this – at least Volvo thinks so and, after a 3-month waiting period, is offering subscription solutions (although these are in the upper price segment), as is Volkswagen, for example. The impressive advantage of the subscription model, generally for all providers of these models, but also and especially for OEMs, is likely to be the high predictability of revenue. These may certainly be lower compared to a very successful sales phase of new vehicles as property, but they are carried out regularly and provide planning security. In times of rising energy, fuel and food costs with persistently high inflation (whereby inflation is actually at the pre-Ukraine crisis level, which is surprisingly rarely mentioned), this is not an insignificant component of a successful financial calculation. Deloitte’s 2022 study “Demystifiying the hype of subscription” already showed that the “subscription model” concept can generally be profitable, especially from the provider’s perspective.

Two points are particularly interesting from the point of view of this article:

- Initiative: The success of subscription models, not only in the automotive sector, but also in relation to other well-known subscription models such as Netflix or Spotify, is not the result of customer demand, but of the providers’ efforts.

The fact is: Users prefer ownership and consumption-based models – these decision criteria are even more important than comfort in the vehicle. This gives a glimpse into the successful model of subscription models for cars, in which large contingents of vehicles with flat-rate equipment can be purchased and offered at low prices in subscription contracts due to the associated discount. Customers accept the fact that they cannot choose a configuration in exchange for the advantage in price and the administratively convenient contract model. This thesis also leads to the fact that very many vehicle users have heard little about subscription models to date, as these are not the result of customer commitment, but a business model created by providers.

Of course, this can be extended to the entire ecosystem of the OEM, which can develop various services from the vehicle itself to countless bookable upgrades in the vehicle within a subscription commerce framework. The subscription model is also extremely interesting in terms of aftersales, as customers of subscription models often spend in certain segments, for example when upgrading to higher vehicle classes or unlocking premium functions – instead of customer cards or loyalty programs, these are therefore a good substitute and can be excellently interlinked with the complex, but above all existing ecosystem of modern OEMs. Not everything needs to be rethought – just well integrated. For example, with soft subscription models that are not fixed, but vary in the monthly fee depending on the convenience services or upgrades flexibly added (or canceled) by the customer. For those who only see steep theses here, note that over 57 percent of all users of subscription models have increased their vehicle-related expenses after taking out a subscription model.

In this context, it goes without saying that the wishes and behavior of car subscription users offer an enormous gain in knowledge in short periods of time. Existing weaknesses in the existing sales channel can thus be revealed more quickly – albeit certainly more ruthlessly -, potential can be tapped more easily and data can be collected in a useful and meaningful way. So it’s time for OEMs to put their distribution channels to the test, because:

- Early involvement pays off: First movers can establish new standards and benefit from the still comparatively sparsely populated competitive landscape.

This can also be translated into an opportunity to gain important competitive advantages over the suppliers pushing into the market from the Far East – whose biggest shortcomings are a lack of functional dealer networks, after-sales systems or direct sales channels that are familiar and convenient for customers. These exist in Germany and Europe and can be scaled up at short notice. Subscription models can make a decisive impact here, for example in the electrification of the German car market: because there are currently practically no affordable electric cars in the under EUR 25,000 purchase price segment, a large number of people are still unable to switch to electric vehicles. The “inflation” caused by inflation, increased energy prices, the cost of living and a high interest rate on loans thanks to the increased prime rate has a considerable impact on the purchase of a new electric car, as the various state premiums have also been drastically changed and reduced – and are no longer available for hybrids. There is hardly any used car market for e-vehicles. The used models are already too outdated in terms of battery capacity and the resulting range, or the prices are simply still too high. Resourceful OEMs can tap into potential here with smart subscription models and offer e-vehicles at prices that are even lower than traditional vehicle leasing. Embedded in a modern system in which it is easy to book via smartphone app, updates work over-the-air(hello UNECE R155 and co.) and maintenance is calculated in a predictive and plannable manner, a user experience for automotive customers is possible that not only generates income for the industry, but also creates an important positive reputation.

Admittedly, over-the-air updates, often still a foreign country for users and sometimes also OEMs, are currently still an abstract-sounding advantage, but: “Over-the-air updates are not yet so well received by customers in Germany, regardless of car subscriptions, but are expected to account for up to 1/3 of car manufacturers’ sales in a few years’ time.“, says Prof. Dr. Wisbert. This also plays a role in the growing importance of subscription models for providers. What’s more, revenues are extremely predictable, meaning that wear and tear and ageing can be easily factored into the business and covered by a subscription rate, especially for fleets that are not very individualized and therefore fairly standardized.

Subscription model vs. classic leasing

The advantages and disadvantages of subscription models, compared to leasing, are largely self-evident from the course of the article so far – for the sake of completeness, however, we will list a few comparative aspects before we attempt a prognosis and examine whether the replacement of leasing as the standard model by subscriptions is more wishful thinking or hard reality. After all, by 2030 there should already be around one million subscription contracts per year – however, by 2022 around 2 million new leasing contracts will be concluded each year, in addition to those already in place. A first discrepancy in the debate?

It should be noted that the market for subscription models is growing rapidly: as recently as 2020, only 40,000 new subscription contracts were concluded for private vehicles, and the number of providers was manageable. Things are different today – new providers are conquering the market and around half a million subscription contracts were concluded in 2023. And even if, according to the Deloitte study, over 39 percent of drivers worldwide, especially among older users, are still decidedly against a subscription model for their own use, and women are also more hesitant to subscribe than men, the number of users is growing rapidly. It remains to be seen whether there really will be one million new contracts per year by 2030, but if the figures continue to rise, it is a real possibility. In order to replace the leasing users quantitatively, however, it would certainly be necessary for a large proportion of the new and existing leasing contracts to be terminated in favor of a subscription model, which is certainly more in the speculative area.

Above all, a comparatively young industry, which largely consists of start-ups, is taking on a major task: The Volkswagen Group alone will conclude almost 300,000 leasing contracts in 2022, some of them with very favorable rates, especially in the small car segment – an impressive figure. It may come as a surprise that Renault is in second place among the most frequently used leased vehicles, Audi in third place less so. The fact that 45 percent of all leased vehicles are SUVs is only partially surprising and once again confirms the trend towards spacious vehicles with moderate fuel consumption – as long as this trend continues and SUVs are not represented in the subscription model in the same numbers as small cars and saloons, it will not be easy to take the crown with new markets. It is of course also possible for large providers to entice customers with very low monthly rates (private users pay an average of EUR 261 per month for leasing, whereas subscription rates are often only available from EUR 300 upwards). By the way, whether subscription model or leasing: the most popular models are the Fiat 500 and the Cupra Formentor.

Subscription vs. leasing: who wins now?

The fact that the subscription rates are sometimes somewhat higher is largely due to the insurance included: Private insurance can often be taken out at much lower rates, especially for experienced users with a low no-claims bonus. The frequently cited advantage of shorter contract terms is also rather hypothetical: there are certainly subscription models with a term of just one month, even one-day contracts: But these are not typical. In most cases, contracts are concluded for at least three years, also in the interest of the providers. 2 years, which can also offer leasing. However, and this is where the subscription model flexes its contractual muscles, some providers require neither minimum terms nor notice periods. Wherever this is the case, the high degree of flexibility in the contract is an absolute winner over leasing.

This is also the conclusion that can be drawn from the direct comparison: Where the subscription model falls behind with its slightly higher overall costs, it offers a high degree of flexibility and very easy handling: all-inclusive is popular, many younger users prefer to spend more money and save themselves the sometimes time-consuming search for insurance policies and providers. The dealership is a thing of the past, as is tedious paperwork – everything is done digitally via app, wirelessly, remotely, from the couch. Anyone who has ever concluded a leasing contract knows about the masses of paperwork that await them. On the other hand, it is easier to choose and customize the vehicle of your choice via leasing, and if you don’t want to get used to new vehicles more often and, for example, like to drive a familiar car as a frequent driver, you are often better off with a leased vehicle. Even those who drive very little and can live well with a small car can benefit greatly from the often very low leasing rates, sometimes without an initial and final installment, which of course also applies to users who are below or above the minimum or maximum age required for subscription models (usually around 73-75 years). For the sake of completeness, it should be mentioned that there are also other opinions regarding the costs, such as that of Mathias Albert (ViveLaCar): “We carried out various model calculations in the study and subsequently. Overall, a subscription is no more expensive than the so-called TCO or leasing. And that with significantly more flexibility at the same time. So this is the product with significantly greater convenience.”

Prof. Dr. Helene Wisbert supplemented our question with a comparison between leasing, purchasing and the subscription model: “With short terms and a mileage of less than 15,000 kilometers per year, car subscriptions and leasing are often superior to a traditional purchase. Customers can take a look at the CAR car subscription factor as a benchmark. Calculation is explained on the website. Anything below a CAR subscription factor of 1.6 is financially attractive – meaning what percentage of the purchase price has to be paid for the subscription rate each month.”

However, one point that this article has left to the end due to its scope is creditworthiness: in a country where the average debt per capita in private households is EUR 28,164, creditworthiness is often suboptimal. The conclusion of a leasing contract is a loan that has a significant impact on the rating and may not even be granted in the first place due to other income obligations. A subscription model, however, is not a loan and therefore does not burden the credit rating – Mathias Albert from ViveLaCar also sees an impressive advantage here for the further scaling of subscription models: “Today, we only have a market share of around 0.5 percent. Scaling will therefore take place very quickly, especially as leasing and the increasingly important credit rating will be important for many companies and private households in the future. As Abo does not trigger a negative rating here as a permanent burden, we are sure that the number of users will increase.”

In this context, it is interesting to note with regard to user behavior that it is currently mainly female vehicle users who are more hesitant to switch to the subscription model. Prof. Dr. Wisbert explains the reasons for this: “Firstly, there is a lack of awareness and secondly, women prefer to keep their cars for longer periods of up to 5 years. Car subscriptions are not designed for this, but for much shorter periods of time and thirdly, the high value of owning the car itself.”

The local usage area also plays a role in the decision: “There is a direct correlation between place of residence and interest in car subscriptions. Customers who live in the countryside prefer to have their own car, while customers in large cities are very interested in car subscriptions. With the exception of Berlin, the number of registered cars is also continuing to rise in Germany’s major cities.“

However, the premise that car procurement is a “man’s business” seems outdated, Mathias Albert continues: “The biggest concern is that women are supposedly less interested in vehicle procurement. But this is precisely where we identified the greatest potential, and after explaining exactly what a car subscription is and that an all-inclusive package can be selected without risk, over 50% of respondents were positive.“

Subscription models until 2030: an outlook

Whether the habits of German car drivers will change so much in the next seven years that the subscription model can replace classic leasing as the standard model seems highly speculative at this stage. The survey participants in the few published studies on the subscription model are too small, often barely more than the 1,000 participants absolutely necessary for a reliable study. This group size allows for a statistically sufficiently diverse group of respondents, but is it really reliable in terms of how many subscription model contracts could be concluded by 2030? Both Prof. Dr. Wisbert and Mathias Albert gave us an answer to this question. “The projection is not based on the survey, but on market developments over the next few years. The market for car subscriptions is developing very dynamically.”, says Prof. Dr. Wisbert. “We believe that the market for car subscriptions will grow to around 10% of the total market.”. Mathias Albert lets us know in this context, as well as: “Subscription will not only overtake leasing, but will also cannibalize cash purchases and traditional financing in particular”.

However, it is also certain that users value a simple customer journey that offers an experience, a sustainably positive experience that fits easily and seamlessly into a digital ecosystem in Industry 4.0. Users want to be flexible, pay little attention to details, experience new things – new vehicles, new lifestyles, new experiences. Mathias Albert from ViveLaCar also thinks that the subscription model is a sensible intermediate option between car sharing, leasing and ownership, and we would like to give him a final word: “We believe that more brands and models will be available by subscription in the future. We are also seeing greater demand for commercial vehicles and luxury vehicles, and the study clearly showed that subscription models will also be in greater demand in the small car segment in the future. We will therefore expand the range and further improve the digital service, including ongoing offers during the subscription period.”

Will this be enough to replace traditional leasing? Time will tell, there is potential. As always in life, however, it is also important to develop these – it is difficult to say today, November 2023, whether the up-and-coming, dynamic start-ups will be able to hold their own against the established but stolid OEMs with their sometimes somewhat dusty structures, whether Far Eastern providers will force their way onto the market with fast, digital concepts or whether ownership will remain a status symbol. However, it is safe to say that the “subscription model” concept is a serious contender in the ring.